Delayed Gratification & The Power of Compounding

A simple but amazing formula to success in accumulating wealth and achieving financial independence

A simple & durable rule for successful investing for beginners & pros alike is:

Delay Gratification and understand the power of Time and Compounding

Neither is easy as we are not wired evolutionarily to delay consumption or to think exponentially rather than linearly.

The marshmallow experiment was a classic study in psychology of delayed gratification. An experiment involving kids under 7 years old, offering them one marshmallow immediately and then another if they waited 15 minutes before consuming the first. Longitudinal studies with these cohorts suggested positive life attributes associated with ability to delay gratification. I have attached the study below for those who want to dig in deeper.

The power of compounding is so great that people have found it necessary to attribute an Einstein quote to it (whether he actually said this is not clear)

“Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t pay it”

A classic teaser involves asking the question - “if lilies in a pond double in number everyday starting with one on the first day, and it takes 15 days to fill half the pond, then how long does it take to fill the entire pond with lilies?”

A popular answer that humans who are wired to think linearly give = 30 days

The right answer of course = 16 days ( as you can see from the pie chart below)

The chart above depicts a powerful message visually - nothing much happens in the first 10 days or so. At the end of 10 days the pond is barely 1.5% full. But, you need those 10 days as a launching pad for the astronomical growth to come. Day 16 is as big as the first 15 days put together. But you need the set up of those first 15 days to get to experience day 16.

Of course, this is just a shock portrayal of compounding. No investment doubles every day. But, the concept of time working for you and the math of compounding is the same, no matter what the investment return.

The most powerful formula in investing———-> P x (1 + r)^n

So, let’s now come down to earth and consider a more achievable horizon and rate:

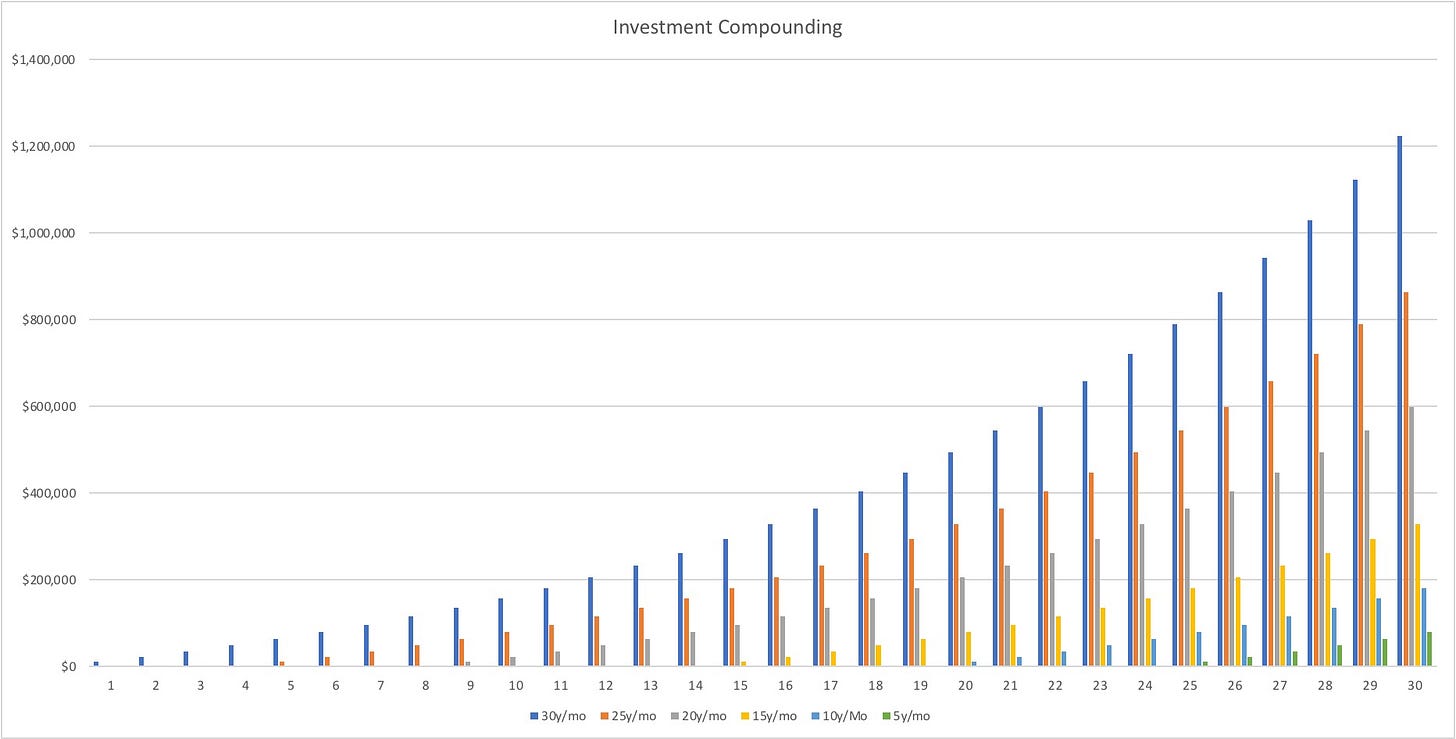

Choose to invest $10,000 a year for 30 years ( viable horizon for many in their 20-30’s). What if you succumb to instant gratification and delay investing by 5,10, 15, 20, 25 years?

Assumes 8% annual return which is a reasonable long term average.

If you delayed your savings & investing by 10 years (invest for 20 years starting in year 10), you will have $90,000 extra dollars in the first 9 years to indulge in momentary gratification, at the cost of ~$600,000 in compounded returns v. Starting right way and investing those extra $90,000.

*Note that the formula for a regular period investment’s future value is: P x [[{(1 + r)^n}-1]/r], where P=periodic investment, r=annual % return, and n=number of periods.

Conclusion

It is easy to get confused about the myriad investment options or other needless complications of investing. But, it pays to understand that the three most important factors is creating a successful investment plan have nothing to do with the knowledge or lack thereof of investing basics or the ability to understand complex investment vehicles. They are Time, Discipline, and Patience!